How They Work

Medical & Dental Billing services typically submit insurance claims electronically for real-time processing at a national clearinghouse (there are dozens of them). The clearinghouse scrubs, formats, and submits claims in real-time to insurance companies for payment. Clearinghouses are and important component to the billing process they have the ability to meet the specific data transmission requirements of every insurance company that accepts electronic claims. This task can be time-consuming to perform independently on your own. You would need to send claims to hundreds of insurance companies, which can be a tedious process. Instead, you only have to send claims to a single clearinghouse. For this, you pay a small fee to some clearinghouses but with some other clearinghouses, this service is free.

You may wonder, why FREE? To understand this, it's important to know how clearinghouses make their income. Clearinghouses are paid by the insurance companies for the claims submitted to them. Insurance companies do this to streamline and cut the cost of claim processing. Most clearinghouses make additional income by charging consumers (doctors and billing services) a small fee as well. So, some clearinghouses make money from both sides of the equation: (1) From insurance companies, and (2) From consumers (end-users of various software, like doctors' offices & billing companies). Several reputable clearinghouses decided to offer this service free to the consumer side in order to attract higher volume of claims submissions and capitalize only on revenue paid by insurance companies.

Now, the majority of the clearinghouses that charge consumers, the fees they charge are typically small and reasonable. For example, some charge 35 cents per claim and some charge a flat monthly fee that's around $50 per month per account, on average.

How to Choose a Clearinghouse

With ClaimTek's software, you're in control to decide which clearinghouses fit your need the best. Having flexibility to use different clearinghouses is important because different types of healthcare providers may require different clearinghouses. Clearinghouses serve certain specialties and have a “payer list,” which is a list of all the insurance companies they are connected to. As a billing company, you may use one clearinghouse to bill for a Family Practice client in Oklahoma that accepts Medicare, Medicaid, BCBS of OK, UnitedHealthcare, Medica, and Bright Health. While for a Home Health client in Florida that only accepts Medicare and Medicaid, you may use a different clearinghouse.

Of course, the cost of the clearinghouse is also a factor. Billing companies often bill for 10, 20, or 50+ clients, so an expensive clearinghouse would eat into profit margins and cause difficulty in scaling up. When you have your own business, and especially with employees, controlling expenses is often a key element for reaching a good level of profitability. You need flexibility and the freedom of choice. After all, that's one of the main benefits of having your own independent business.

With ClaimTek you always have options and make the final decision, but we help you get everything setup. This would be covered during Stage 3 of our 3-Stage Training when on-boarding a new client.

Does ClaimTek Benefit from Clearinghouses Fees?

Yes, ClaimTek receives a small commission from clearinghouses we've built partnerships with. We partner with reputable clearinghouses that provide top notch service at a reasonable fee. However, you're not limited to the clearinghouses we recommend. Our software submits claims in a compliant EDI format that's accepted by all clearinghouses and insurance companies.

- No setup fees

- No annual fees

- RCM portals & features available

- Varying monthly fees

- $125/Month up to 300 Claims

- No setup fees

- No annual fees

- RCM features unavailable

- Free, limited support options

- No setup fees

- No annual fees

- RCM features available

- Flat rate

- $25-$100/Monthly plans

- Unlimited Claims per provider

- Multiple providers per account

Compare Costs

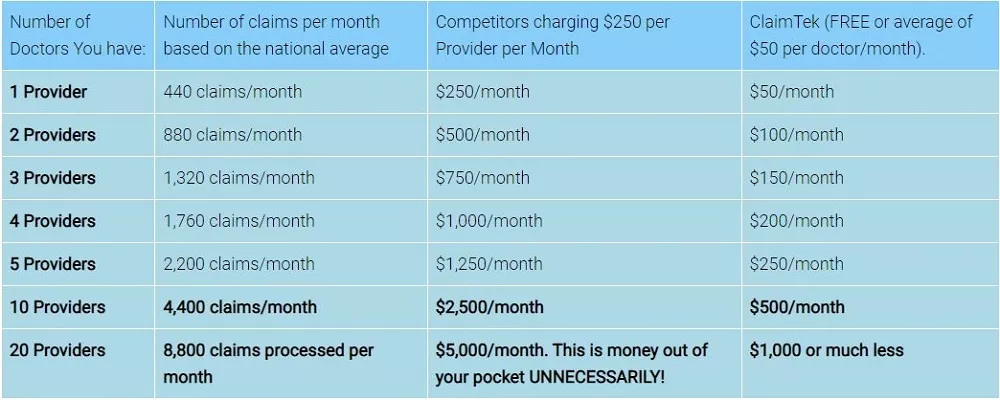

If you are a ClaimTek client and have 10 doctors, for example, your clearinghouse fees will be free or up to around $500. With some competitors, you're looking at a cost of around $250 per provider, per month ($2,500 for 10 doctors). If you have 20 clients, your fees will double to $5,000 per month! With ClaimTek your cost would be around $1,000 or much less, and you have many choices of clearinghouses. Let’s take a look at some examples:

ClaimTek claims processing is fast and inexpensive. You can send claims direct & FREE to many insurance companies. ClaimTek will save you thousands of dollars each month adding tens of thousands to your bottom line each year, and maximize client acquisition potential by allowing you to work with every specialty, location, and insurance company in the entire health care industry.